A Cost Variance Can Be Further Separated Into the Quantity Variance and the Price Variance.

Learning Objective

- Calculate and analyze direct materials variances.

Question: In the dialogue at the beginning of the affiliate, the president of Jerry'due south Ice Cream was concerned about pregnant cost overruns for direct materials. We cannot simply explain these costs by maxim that "we paid likewise much for materials" or "likewise many materials were used in production." Variances must exist calculated to place the exact cause of the cost overrun. What variances are used to analyze the difference between actual direct material costs and standard direct fabric costs?

Answer: The difference between actual costs and standard (or budgeted) costs is typically explained past two split up variances: the materials price variance and materials quantity variance. The materials price variance is the difference between actual costs for materials purchased and budgeted costs based on the standards. The materials quantity variance is the deviation between the bodily quantity of materials used in product and approaching materials that should have been used in production based on the standards.

To this point, we have provided the data for Jerry's Ice Cream necessary to calculate standard costs. However, you must also have the actual materials cost and materials quantity data to calculate the variances described previously. The bodily data for the year are as follows:

| Sales volume | 210,000 units |

| Direct materials purchased | 440,000 pounds |

| Cost of direct materials purchased | $i.twenty per pound |

| Direct materials used in production | 399,000 pounds |

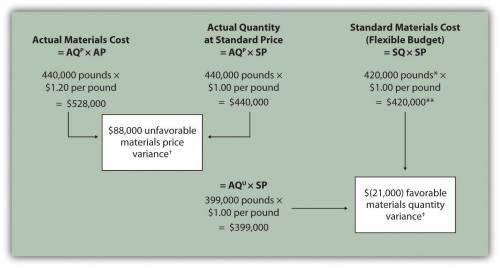

Recall from Figure ten.1 "Standard Costs at Jerry'due south Ice Foam" that the straight materials standard price for Jerry'south is $i per pound, and the standard quantity of direct materials is ii pounds per unit. Effigy x.four "Straight Materials Variance Assay for Jerry's Water ice Cream" shows how to summate the materials price and quantity variances given the actual results and standards data. Review this figure carefully before moving on to the next department where these calculations are explained in item.

Figure 10.four Straight Materials Variance Assay for Jerry's Ice Cream

Note: AQP = Actual quantity of materials purchased. AP = Bodily price of materials. AQU = Actual quantity of materials used in production. SP = Standard cost of materials. SQ = Standard quantity of materials for bodily level of activity.

*Standard quantity of 420,000 pounds = Standard of 2 pounds per unit × 210,000 bodily units produced and sold.

**$420,000 standard direct materials cost matches the flexible budget presented in Note 10.18 "Review Problem 10.2".

† $88,000 unfavorable materials cost variance = $528,000 – $440,000. Variance is unfavorable because the actual cost of $1.20 is college than the expected (budgeted) price of $1.

‡ $(21,000) favorable materials quantity variance = $399,000 – $420,000. Variance is favorable considering the actual quantity of materials used in production of 399,000 pounds is lower than the expected (approaching) quantity of 420,000 pounds.

Direct Materials Cost Variance Calculation

Question: The materials price variance answers the question, did we spend more than or less on direct materials than expected? If the variance is unfavorable, we spent more expected. If the variance is favorable, we spent less than expected. How is the materials price variance calculated?

Reply: Equally shown in Effigy 10.4 "Direct Materials Variance Analysis for Jerry's Ice Cream", the materials toll variance is the difference between the actual quantity of materials purchased at the actual price and the actual quantity of materials purchased at the standard price:

Fundamental Equation

Materials price variance = (AQP × AP) – (AQP × SP)

Alternative Calculation. Since we are holding the actual quantity abiding and evaluating the divergence between actual price and standard price, the materials toll variance calculation can be simplified as follows:

Cardinal Equation

Materials price variance = (AP – SP) × AQP

Note that both approaches—the direct materials cost variance calculation and the culling calculation—yield the aforementioned result.

When labeling the variances calculated in this chapter, notice that all positive variances are unfavorable and all negative variances are favorable (i.due east., unfavorable cost variances increment expected costs and favorable cost variances decrease expected costs). As yous calculate variances, you should retrieve through the variance to confirm whether information technology is favorable or unfavorable. For instance, the materials price variance calculation presented previously shows the actual price paid for materials was $ane.20 per pound and the standard price was $one. Clearly, this is unfavorable considering the actual toll was higher than the expected (budgeted) cost.

Directly Materials Quantity Variance Adding

Question: The materials quantity variance answers the question, did nosotros use more or fewer direct materials in production than expected? If the variance is unfavorable, we used more than expected. If the variance is favorable, we used fewer than expected. How is the materials quantity variance calculated?

Answer: Equally shown in Effigy 10.four "Directly Materials Variance Assay for Jerry'due south Ice Cream", the materials quantity variance is the difference between the actual quantity of materials used in production at the standard price and the standard quantity of materials allowed at the standard price:

Key Equation

Materials quantity variance = (AQU × SP) – (SQ × SP)

The standard quantity of 420,000 pounds is the quantity of materials allowed given bodily product. For Jerry'due south Ice Cream, the standard quantity of materials per unit of production is 2 pounds per unit of measurement. Thus the standard quantity (SQ) of 420,000 pounds is ii pounds per unit × 210,000 units produced and sold.

Alternative Calculation. Since we are belongings the standard cost constant and evaluating the difference between actual quantity used and standard quantity, the materials quantity variance adding can be simplified equally follows:

Key Equation

Materials quantity variance = (AQU – SQ) × SP

Annotation that both approaches—the straight materials quantity variance adding and the culling calculation—yield the same issue.

The materials quantity variance calculation presented previously shows the bodily quantity used in production of 399,000 pounds is lower than the expected (approaching) quantity of 420,000 pounds. Clearly, this is favorable because the bodily quantity used was lower than the expected (budgeted) quantity.

Possible Causes of Direct Materials Variances

Question: The managerial auditor at Jerry'south Ice Cream will probable investigate the cause of the unfavorable materials toll variance of $88,000. This volition lead to discussions with the purchasing department. What might have caused the $88,000 unfavorable materials toll variance?

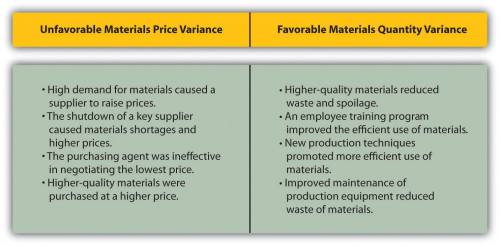

Answer: The left panel of Figure x.five "Possible Causes of Direct Materials Variances for Jerry'southward Water ice Foam" contains some possible explanations for this variance.

Effigy 10.5 Possible Causes of Direct Materials Variances for Jerry'south Water ice Cream

Any the crusade of this unfavorable variance, Jerry's Ice Cream will likely take action to improve the cost problem identified in the materials price variance analysis. This is why we use the term control phase of budgeting to describe variance analysis. Through variance analysis, companies are able to place problem areas (textile costs for Jerry'southward) and consider alternatives to decision-making costs in the future.

Question: Jerry's Ice Foam might also cull to investigate the $21,000 favorable materials quantity variance. Although this could be viewed equally good news for the company, management may desire to know why this favorable variance occurred. What might have caused the $21,000 favorable materials quantity variance?

Answer: The correct panel of Figure 10.v "Possible Causes of Directly Materials Variances for Jerry's Ice Cream" contains some possible explanations for this variance.

Notice how the cause of one variance might influence another variance. For instance, the unfavorable price variance at Jerry's Ice Cream might take been a result of purchasing loftier-quality materials, which in turn led to less waste in production and a favorable quantity variance. This also might accept a positive impact on direct labor, every bit less time will be spent dealing with materials waste material.

Note 10.26 "Concern in Action x.2" illustrates just how important it is to rails straight materials variances accurately.

Business in Action 10.2

The Event of Rising Materials Costs on Automobile Suppliers

In the get-go six months of 2004, steel prices increased 76 percent, from $350 a ton to $617 a ton. For machine suppliers that use hundreds of tons of steel each year, this had the unexpected effect of increasing expenses and reducing profits. For example, a major producer of automotive wheels had to reduce its annual earnings forecast by $10,000,000 to $fifteen,000,000 as a issue of the increase in steel prices.

Nearly motorcar part suppliers operate with very minor margins. GR Leap and Stamping, Inc., a supplier of stampings to automotive companies, was generating pretax profit margins of about 3 per centum prior to the increase in steel prices. Profit margins have been cut in half since steel prices began rising.

These sparse margins are the reason motorcar suppliers examine direct materials variances then advisedly. Any unexpected increase in steel prices will likely crusade meaning unfavorable materials price variances, which will atomic number 82 to lower profits. Machine part suppliers that rely on steel will go on to scrutinize materials toll variances and materials quantity variances to control costs, particularly in a period of rising steel prices.

Source: Brett Clanton, "Steel Costs Slam Auto Suppliers," The Detroit News, June 29, 2004, http://www.detnews.com.

Clarification of Favorable Versus Unfavorable

Question: Why are variances labeled favorable or unfavorable?

Respond: The terms favorable and unfavorable chronicle to the impact the variance has on budgeted operating turn a profit. A favorable variance has a positive bear on on operating profit. An unfavorable variance has a negative impact on operating profit. Companies using a standard cost organization ultimately credit favorable variances and debit unfavorable variances to income statement accounts. The appendix to this chapter describes this process in further detail.

Cardinal Takeaway

- Standard costs are used to found the flexible budget for direct materials. The flexible budget is compared to actual costs, and the deviation is shown in the class of two variances. The materials price variance focuses on the price paid for materials, and it is defined equally the difference between the actual quantity of materials purchased at the bodily price and the actual quantity of materials purchased at the standard toll. The materials quantity variance focuses on the quantity of materials used in production. It is defined as the difference between the actual quantity of materials used in production and approaching materials that should have been used in product based on the standards.

Review Trouble ten.3

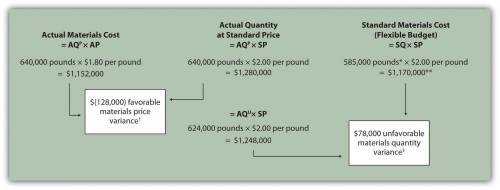

Carol's Cookies expected to utilize one.v pounds of directly materials to produce 1 unit of measurement (batch) of production at a cost of $2 per pound. Bodily results are in for final year, which indicates 390,000 batches of cookies were sold. The company purchased 640,000 pounds of materials at $1.80 per pound and used 624,000 pounds in production.

- Calculate the materials toll and quantity variances using the format shown in Figure 10.4 "Directly Materials Variance Assay for Jerry's Ice Cream".

- Use the culling approach to calculating the materials toll and quantity variances, and compare the upshot to the consequence in part 1. (Hint: the variances should match.)

- Propose several possible reasons for the materials price and quantity variances.

Solution to Review Problem ten.3

- Every bit shown in the following, the materials price variance is $(128,000) favorable, and the materials quantity variance is $78,000 unfavorable.

Note: AQP = Bodily quantity of materials purchased. AP = Actual price of materials. AQU = Actual quantity of materials used in production. SP = Standard price of materials. SQ = Standard quantity of materials for actual level of action.

Note: AQP = Bodily quantity of materials purchased. AP = Actual price of materials. AQU = Actual quantity of materials used in production. SP = Standard price of materials. SQ = Standard quantity of materials for actual level of action.*Standard quantity of 585,000 pounds = Standard of i.five pounds per unit of measurement × 390,000 actual units produced and sold.

**$ane,170,000 standard direct materials cost matches the flexible budget presented in Notation ten.18 "Review Problem 10.2", part two.

† $(128,000) favorable materials cost variance = $1,152,000 – $ane,280,000. Variance is favorable because the actual toll of $1.80 is lower than the expected (approaching) toll of $2

‡ $78,000 unfavorable materials quantity variance = $1,248,000 – $1,170,000. Variance is unfavorable considering the actual quantity of materials used in product of 624,000 pounds is college than the expected (approaching) quantity of 585,000 pounds.

- Alternative straight materials variance calculations:

- Possible causes of favorable materials toll variance are

- The supplier had excess materials on manus and lowered prices to sell off inventory;

- New suppliers entered the market, which resulted in an excess supply of materials and lower prices;

- Carol's Cookies' purchasing agent is a strong negotiator and was able to negotiate lower prices than anticipated;

- Lower-quality materials were purchased at a lower toll.

Possible causes of unfavorable materials quantity variance are

- Lower-quality materials resulted in more than waste and spoilage;

- New, inexperienced employees were hired, resulting in more waste;

- Onetime equipment breaking downwardly caused an increased amount of waste.

Source: https://courses.lumenlearning.com/acctmgrs/chapter/10-3-direct-materials-variance-analysis/

Post a Comment for "A Cost Variance Can Be Further Separated Into the Quantity Variance and the Price Variance."